How Covid pandemic affected Bulgaria’s property market and house prices?

From negative forecasts and expectations for possible price drops to a surprisingly high market activity, here’s a detailed review of how the property market in Bulgaria is developing under the current pandemic conditions.

BULGARIAN PROPERTIES take a look at the trends that emerged in the 12 months since Covid-19 hit the world and give some insights on what homeowners in Bulgaria should expect next.

Market Overview

Тhe property market in Bulgaria entered the Covid-19 pandemic in a very good condition with a continuous upward price movement for 5 years in a row and a strong local demand. This demand was supported by growing household incomes, record-low mortgage interest rates and low unemployment.

The lockdown in Q2 of 2020 put the market on a temporary pause but the activity was resumed immediately after the measures were eased in May 2020. Buyers were rushing to buy homes before a possible second wave in Autumn occurs. This lead to a high market activity all through the summer and autumn months, compensating for the lower sales volume in the second quarter.

This turned the second half of 2020 into a very successful one for the Bulgarian residential market which was moving with a pace like that before the Covid-19 pandemic. Property prices continued to grow, although a bit more slowly, but this was expected for 2020 even before the challenges it brought.

The demand spread throughout the country directing interest to previously not so much wanted properties like rural houses, as well as vacation apartments in the ski and beach resorts. This was all driven by the need to have your own space for recreation, outdoor activities, and possibility to work from anywhere where you have a place to stay and a good internet connection.

The main driver of the residential market was more than ever the local demand as travel restrictions put the plans of the foreign buyers on hold. Bulgarians too experienced travel restrictions to favorite locations like Greece for summer holidays and this had a positive effect on their demand for summer vacations in Bulgaria which resulted in a higher demand for vacation properties.

Overall, in 2020 the residential property market was less hit by the corona crisis than some other market segments (like offices, retail, and hotels). It even benefited from a growing interest and demand for quality housing space, second homes and spread of the demand throughout the country which will help for a more balanced regional development.

A major role in preserving the market activity and trust was played by the banks which continued lending at even lower interest rates (below 3%). Another factor was the continuing development of the residential projects where the construction did not stop. And the general economic recovery in the second half of the year, preserving the low unemployment (around 5%) and the growing incomes of the households (with about 10% annually).

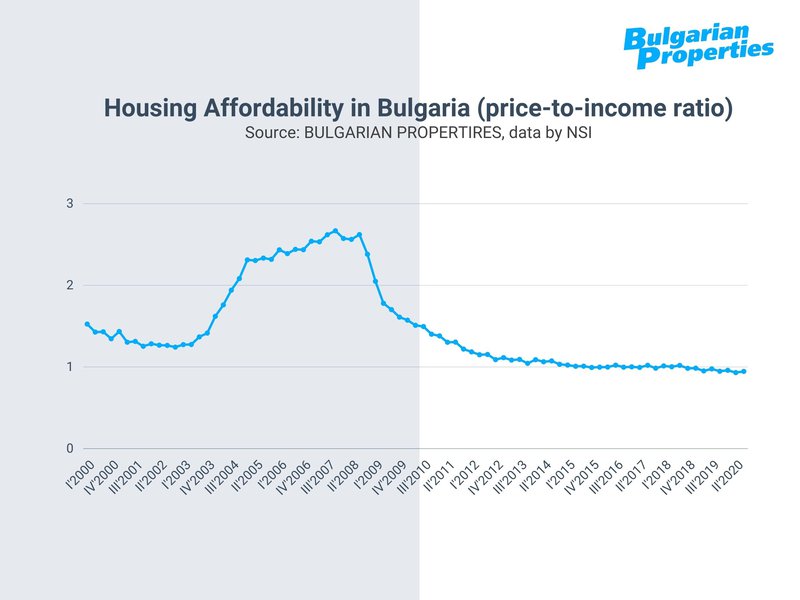

Housing Affordability

Due to the continuous rise in households’ incomes which is faster than the house price growth, the affordability in Bulgaria has been improving over the past years and 2020 makes no exception.

The affordability indicator measures the price to income ratio (the average price per sq.m. to the average monthly salary in Bulgaria), showing how many monthly salaries are needed for the purchase of 1 sq.m. of housing space.

The coefficient equals to 0.94 in the end of 2020 meaning that 1 monthly salary can buy a little over 1 sq.m. It has stayed around this level since 2015 and is well below its peak value reached in Q3 of 2008 – 2.62.

This indicates favorable property buying conditions and a stable housing market.

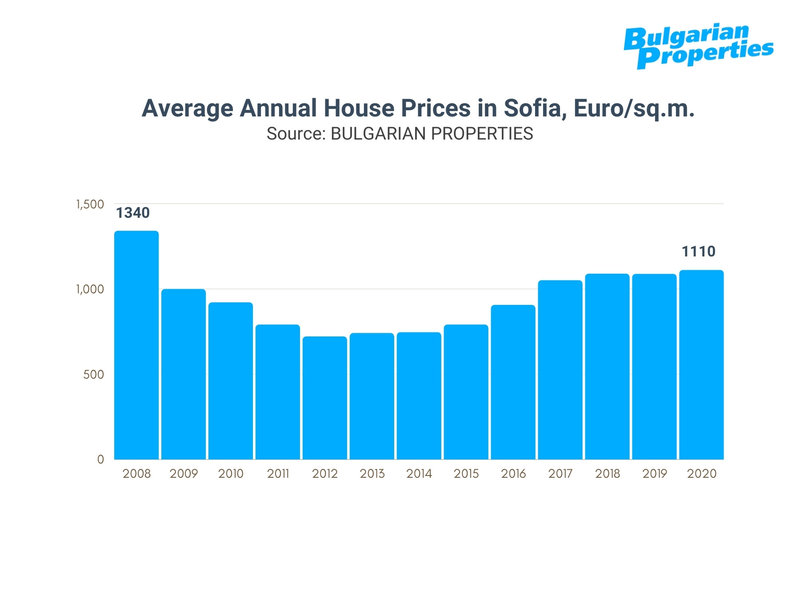

Sofia

Data by BULGARIAN PROPERTIES based on concluded deals shows that after price rise accelerated in the first quarter of 2020, in the second quarter it returned to levels of about 1,080 Euros / sq.m., around which it has stayed over the past few years.

A new acceleration of the market followed and in the third quarter the average price of housing in the Bulgarian capital became 1,115 Euros/sq.m. and 1,120 Euros/sq.m. in Q4 of 2020.

In result, the residential market in Sofia ended 2020 with an average price of 1,110 Euros/sq.m. compared to 1,087 Euros/sq.m. in 2019 which sums up to a 2% annual price increase.

An interesting observation about the shift in demand due to pandemic is the need for more space and an extra room in the apartment which has lead to an increased demand for 2, 3-bed and larger apartments. Properties on the ground floor with their own gardens and apartments on the high floors with big balconies are all very much preferred.

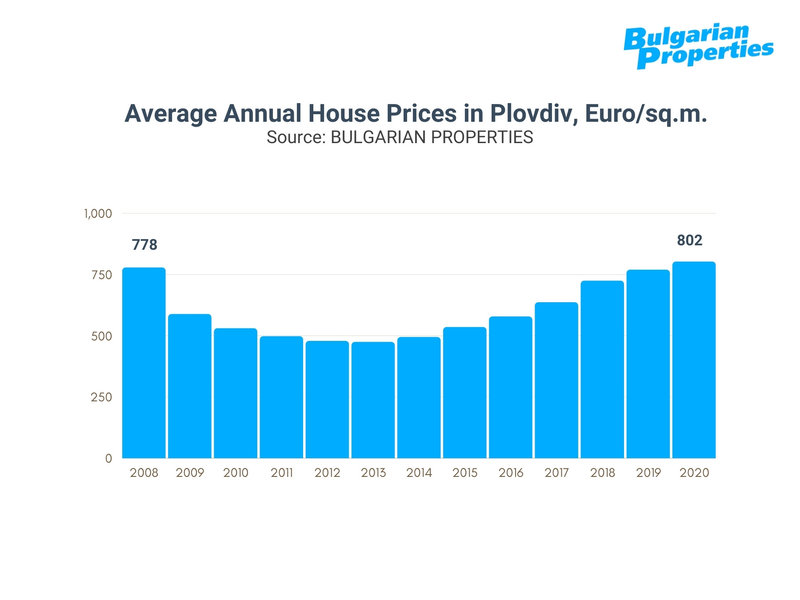

The Other Big Cities

The property markets in the other 3 top biggest cities in Bulgaria – Plovdiv, Varna and Burgas follow the same trends as in the capital of Sofia. All of them had a temporary slow down due to lockdown in Q2 of 2020 followed by a quick recovery and price growth in the second half of the year.

Overall, all of them marked an annual price increase of between 2 and 5%.

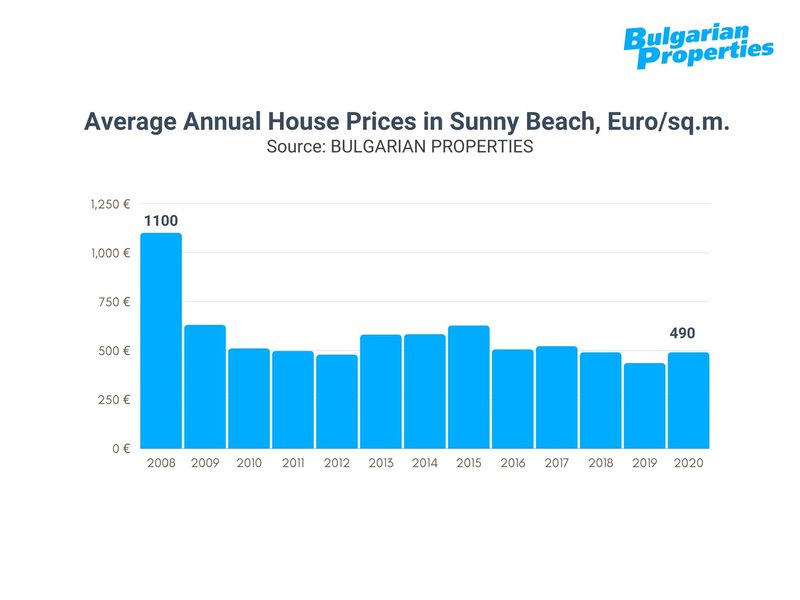

Holiday Homes in the Beach and Ski Resorts

The vacation property segment remained stable and gained popularity among Bulgarian buyers. Previously, the biggest ski and beach resorts were dominated by foreign buyers but due to travel limitations, in 2020 the local demand was the main driving factor.

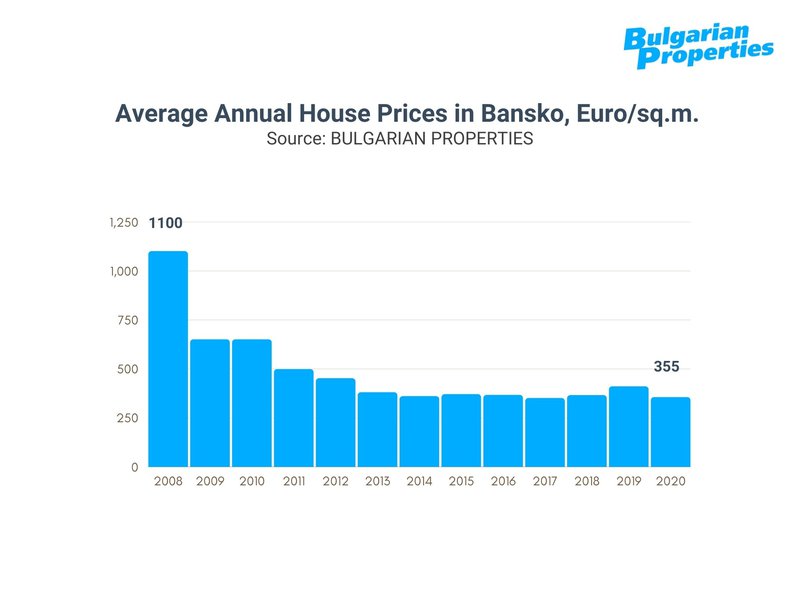

The prices in the biggest beach resort – Sunny Beach, and the biggest ski resort – Bansko remained almost unchanged having into account that this market segment never managed to recover fully from the economic crisis in 2008 and the prices are much below the levels reached in the end of the previous decade.

The average price of sold apartments in Sunny Beach in 2020 was 490 Euros/sq.m. and in Bansko – 355 Euros/sq.m.

Rural Houses

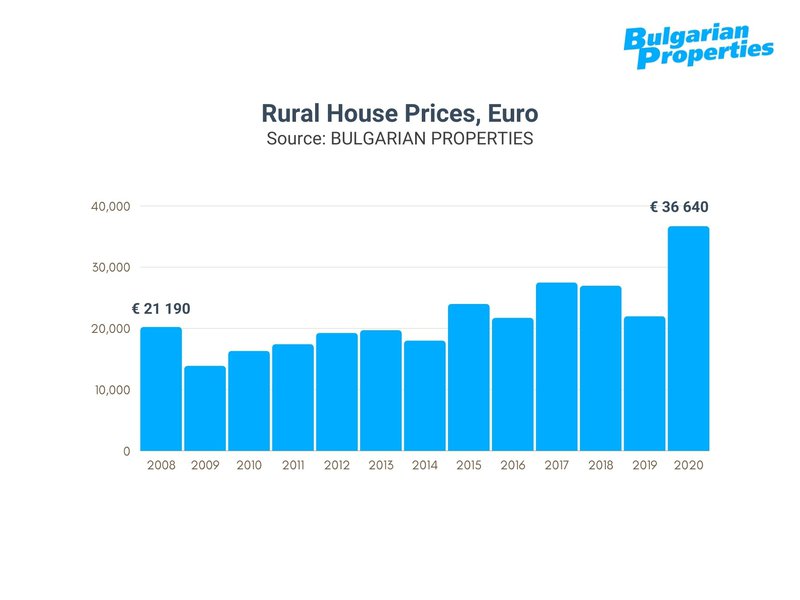

The rural houses are the big winner from the pandemic. Their demand increased and the concluded deals rose by 20% in 2020. This was in result of the greater need for a private outdoor space and a safe place for isolation from the virus.

The buyers look for more contemporary, fully furnished, and ready-to-use houses which resulted in an increase in the average price of the purchased rural homes from 20-25,000 Euros previously to 35-40,000 Euros during the pandemic.

Conclusions

In 2020 the Bulgarian residential property market managed to remain stable and relatively unaffected by the Covid-19 pandemic. The prices in general remained stable and continued to grow slowly.

The big cities returned to growth and regained the levels reached before the pandemic.

The ski and beach resorts together with the rural properties all benefited from the new needs of the buyers and the increased demand.

Expectations for 2021

In the beginning of 2021 the demand is even higher than in the beginning of 2020 which promises a strong market. Still, the situation is very unstable. Finding new mutations of the virus and tightening the anti-epidemic measures may cause the market to slow down.

Thus, a key role for the market development in 2021 will continue to play Covid-19 pandemic. We can expect episodes of eased measures and high market activity to be followed by tightened measures and lower activity. Very similar to what happened in 2020, especially in its final months during the second wave.

Fortunately, people have now got used to the protective measures, many of them have healed from Covid-19 and hence, there is no panic. Business continues as usual and deals are concluded as real estate agencies and other related businesses are allowed to remain open during lockdowns.

Market activity will be stimulated by the need for bigger space and having own place for permanent living and vacations. In 2021, banks and their mortgage policies will continue to play an important role. Unemployment also comes forth as a leading factor in market development which must be closely monitored. So far, all the above factors have had a positive effect on property demand.

In a positive scenario and successful coping with the corona crisis, we can expect an active property market and stable prices in 2021. In a worse scenario we can expect a reduced volume of transactions, but a drop in prices is unlikely to occur within this year, as liquidity in the economy is high.

The local demand will continue to be the main driving factor of the market as it is the only audience which is able to travel and take advantage of the offers on the market. If there are better opportunities to travel, especially in summer months when tourism is expected to start to recover, we can expect some part of the foreign demand to materialize in concluded property deals.

View our top properties for sale

How much is your home in Bulgaria worth now? Get an online valuation here

Sell your property with us