The Housing Market in Sofia - Current Trends and Perspectives

We can say that 2018 was successful, interesting and dynamic for the real estate market in Sofia, but with much smoother growth of all indicators, as well as many micro cycles that kept changing the property market in the different months. In general, we can define it as a stabilizing year for the housing market in the capital of Bulgaria.

We can say that 2018 was successful, interesting and dynamic for the real estate market in Sofia, but with much smoother growth of all indicators, as well as many micro cycles that kept changing the property market in the different months. In general, we can define it as a stabilizing year for the housing market in the capital of Bulgaria.

The demand for properties in Sofia remained high throughout the year, and a significant part of the demand is still unsatisfied.

The main indicators for the housing market in Sofia for 2018 are: slowing the growth of prices to about 5% on an annual basis, stabilization of the market at price levels around 1,000 EUR/sq.m, twice more affordable homes compared to 10 years ago, an increasing supply of new-built housing, which is much preferred by the buyers.

The market outlook is positive, with our expectations for prices to stay around current levels over the next 1-2 years.

Average Prices and Annual Change

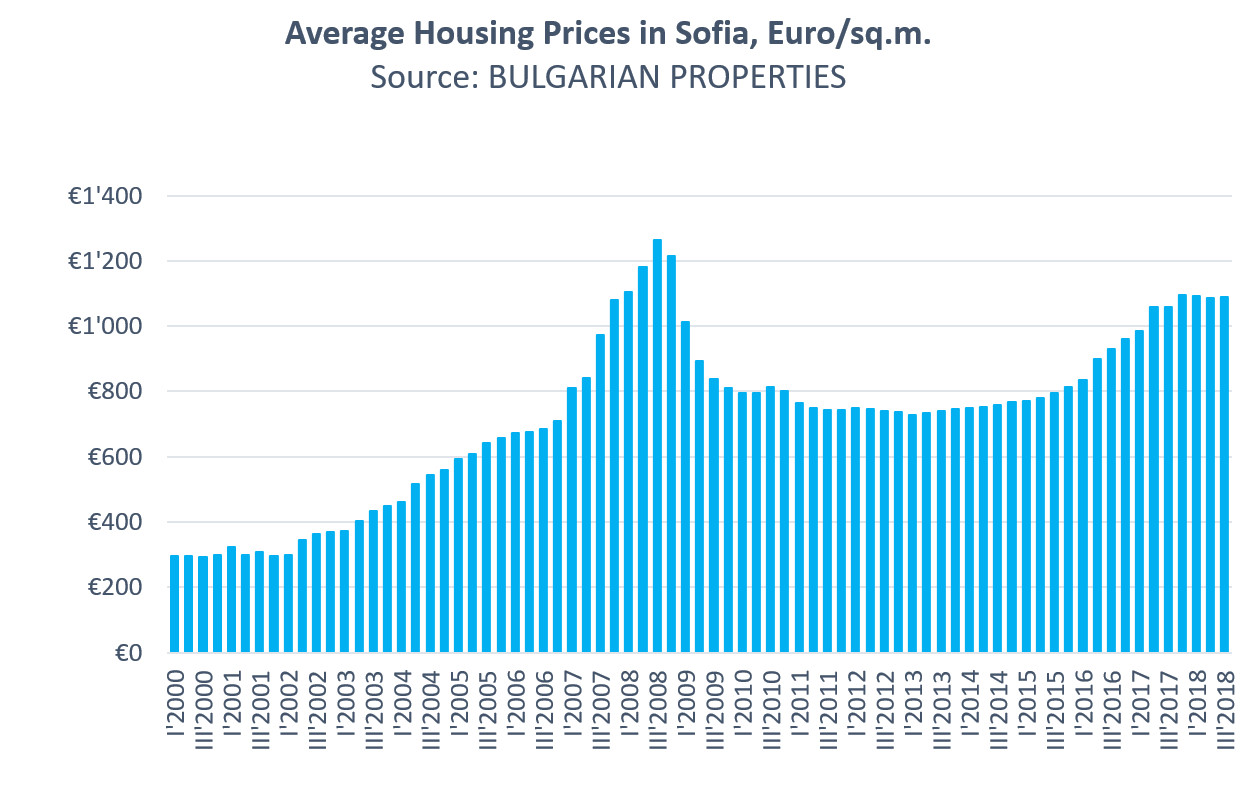

BULGARIAN PROPERTIES data indicate that in 2018 prices in Sofia kept the levels reached at the end of 2017 and remained unchanged in the 3 consecutive quarters.

The average dwelling price in Sofia in the 3 rd quarter of the year is 1,090 EUR / sq.m. compared to 1,086 EUR / sq.m. in the 2nd quarter and 1 092 EUR / sq.m. in the beginning of the year. It is already a year that the psychological limit of 1 090 EUR / sq.m. cannot be passed. The market is expected to stabilize and develop much more smoothly than the previous years of catching up.

On the average price chart, it can be seen that the prices are well below the levels 10 years ago when they reached 1,120 EUR / sq.m

The average purchase price of dwellings in Sofia is EUR 86,260 compared to levels of around EUR 90,000 in the previous quarters. This trend reflects the increase in the share of purchased 1-bedroom dwellings and the tendency to look for smaller areas at the expense of rising prices per sq.m.

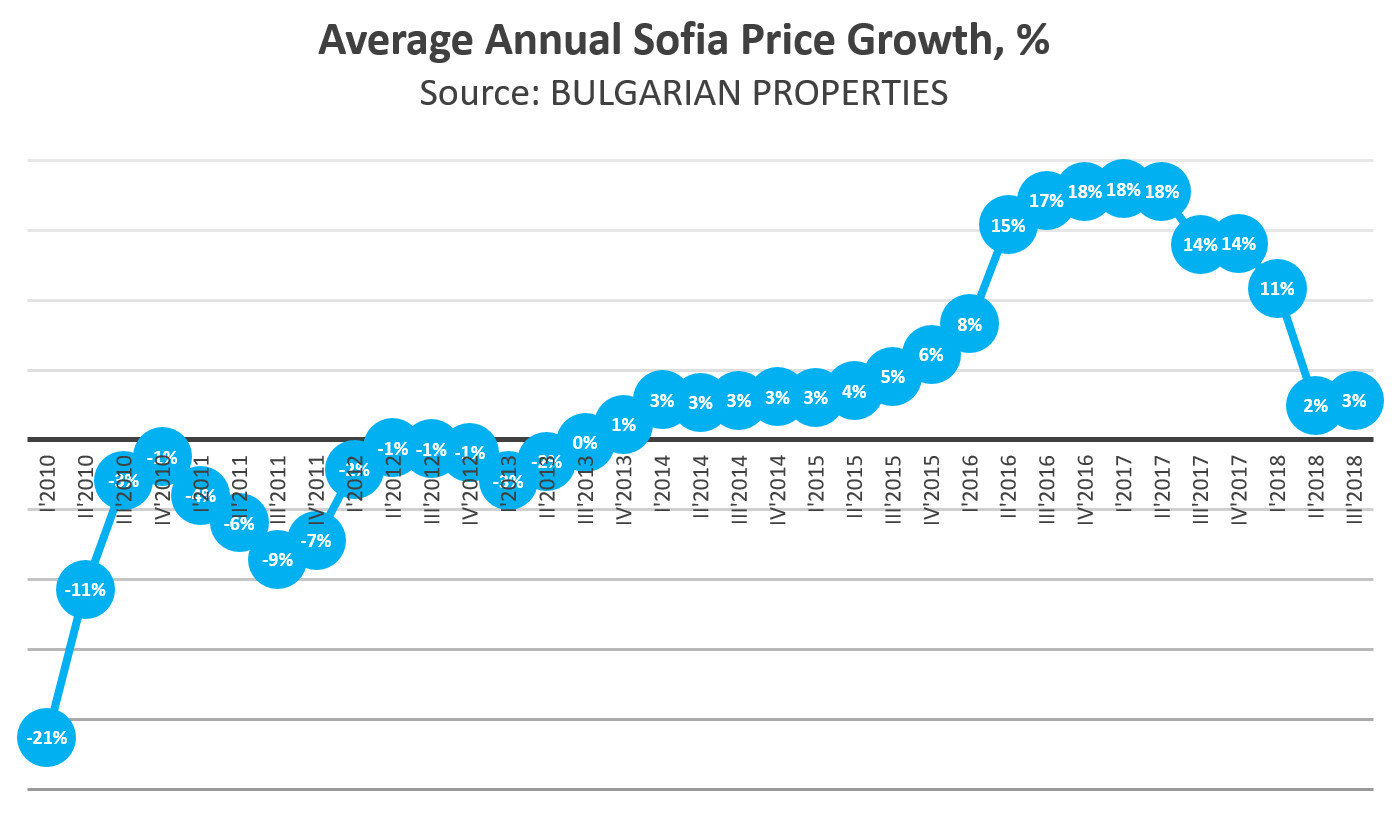

On the graphs, you can see the annual growth of prices by quarters. The annual price increase in the 3rd quarter is 3% and for the first 9 months, the annual growth in prices in Sofia is 5% compared to the same period last year.

Thus, our last years' forecast for the slowdown of the growth pace to around 10% and gradual rebalance of the market for the moment are justified, with even the price rise in 2018 being below our expectations.

Affordability

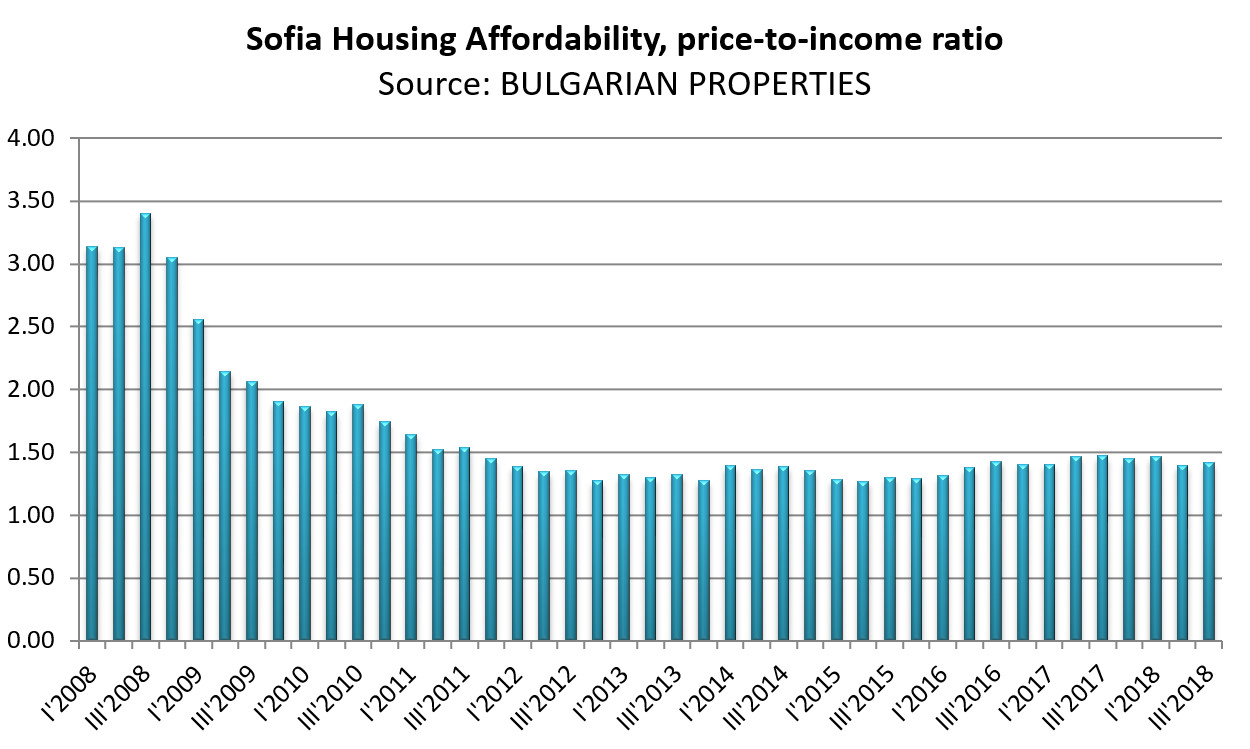

The price affordability index in Sofia (ratio of the price of dwellings per square meter to the average salary in Sofia) is measured to be 1.42 in Q3 of 2018, a slight decrease compared to the 1.45-1.47 levels achieved in the previous quarters. This means that the properties in Sofia are now slightly more affordable than in 2017 and the beginning of this year.

This is due both to the slowing of the growth in prices and to the increased salaries, whose growth is also slowing down and even declining in the third quarter.

Let us recall that this ratio is far from the peak value of the coefficient 10 years ago (3.5) and shows that in general the properties in Sofia are at least twice more affordable compared to 2008.

Sales volumes

According to the data of the Registry Agency for the 3rd quarter in Sofia, 6,376 real estate sales were registered compared to 6,300 for the same period in 2017, which is only 1.2% Year-over-Year growth. After the sales volume increased to 6-8-10%, it now appears to be slowing down.

However, the stats don’t count the purchased new-built dwellings, which will be listed as sales upon their completion. Their share of the total housing market according to our observations is about 60-70% of all sales in Sofia. So, we believe the sales volume that is reported in these statistics is strongly underestimated.

New Construction

New building permits issued in Sofia increased by 14.5% for the first 9 months compared to the same period in 2017.

In the third quarter, 296 new permits for residential buildings were issued according to NSI (National Statistics Institute) data, which is a record-high for the last years. Perhaps this is the only indicator that has managed to return to pre-crisis levels from 10 years ago.

Check out our latest offers in Sofia

Preferred Neighbourhoods and Property Prices There

Observations from BULGARIAN PROPERTIES indicate that most of the purchased dwellings in the 3rd quarter of 2018 are in Vitosha, mainly due to the strong interest in our exclusive complex Modera Residence.

The other popular neighbourhoods in Sofia are Krastova Vada, Studentski Grad, Manastirski Livadi, to which we add district Vrabnica 2 with continuing active sales of profitable new-build dwellings in Sofia North Park complex, near the North Park and metro station.

The average prices in the most popular quarters in the 3rd quarter are:

• Vitosha - 960 EUR / sq.m.

• Studentski Grad - 1,070 EUR / sq.m

• Krastova Vada - 1,270 EUR / sq.m.

• Manastirski Livadi - 1 \,010 EUR / sq.m.

• Mladost 4 - 1,080 EUR / sq.m.

• Vratnitsa 2 - 960 EUR / sq.m.

The most expensive are the dwellings in the Centre and Lozenets - between 1,650 EUR / sq.m. and 2,000 EUR / sq.m.

Traditionally, there is also interest in Mladost, but the supply there is quite limited. Lyulin attracts interest with low prices for new-built dwellings.

An interesting area is Pavlovo, Buxton, Ovcha Kupel and Karpuzitsa districts. This southern area is transformed by the progress of the metro, the expansion and construction of new boulevards, the improvement of the number 5 tram line, the available universities, medical centres and transport links, which give a very strong impetus to the development of the area and the new construction gradually changing its appearance.

Parameters of the Purchased Housing

In the 3rd quarter, the largest share of the purchased apartments was the 1-bedroom apartments. They account for 65% of the total purchase of dwellings, according to BULGARIAN PROPERTIES, and the availability of 1-bedroom apartments in new-built development is the fastest running out one. 25% of the purchased apartments are 2-bedroom ones and the studios are 8%.

The average area of the purchased dwellings is 79 sq.m. The 1-bedroom apartments have an average area of about 70 square meters and the 2-bedroom apartments - 105 sq.m.

95% of the purchased dwellings are in brick buildings, most of them new construction. Only 7% are deals with fully furnished apartments. 40% of the purchased dwellings are heated by a thermal power plant.

The average age of the properties being sold at the beginning of the year, is 102 days (about 3.5 months) and decreases from 122 days at the beginning of the year. Discounts made on offer prices are insignificant - on average of 0.2%.

Over the past year, we have seen a growing interest in gated complexes with private parks, greenery, children's playgrounds and recreational areas. Great attention is paid to the quality of life, especially when buying homes for personal use, but the investment interest in such complexes is great as they promise better rent levels and greater sustainability of the investment.

Summary of 2018

The market in Sofia has been stable and balanced since the spring of this year. At that point, a greater supply appeared on the market and the buyers started to choose more and slow down decision-making. They showed willingness to buy at prices up to about 1,000 EUR / sq.m.

In the second half of the year, we had a stronger market in Sofia, especially in August, when sales volumes reached record levels and then normalized to levels slightly above those of last year.

As a conclusion for 2018, we can say that the housing market in Sofia is stable, the demand is available, but it is only for the well-designed and market-priced projects. Good examples are the new residential developments which we have agreed to market exclusively. They generate constant interest and maintain consistent sales levels throughout the year.

Dwellings in the secondary market, which are well-priced in terms of their characteristics, are sold within one month, which is a very good pace for the market. Unfortunately, a large number of sellers still have excessive price expectations and we have many homes that remain on the market for months.

Buyers continue to consider their property investments carefully and review most of the properties on the market, not buying at all costs.

Prospects

In the recent months there is much speculation about the decline in market activity and property prices, but it should be noted that there are currently no objective factors to support these projections.

The most likely scenario for the development of the housing market in Sofia is the property prices to stay around the current levels and to have a stable property market with very good supply over the next 1-2 years.

The local demand will continue to be a major driver, and expected economic growth, low unemployment and still low interest rates on mortgage loans will continue to have a favourable impact on the property market in 2019.

Check out our latest offers in Sofia

Sell property with us!

Free express evaluation of your property