Sofia housing market at the end of 2022 - a record price growth

In 2022 the housing market in Bulgaria became red hot, experiencing price growths which we hadn't seen in over a decade. This is a direct consequence from the high inflation, which has caused house prices to accelerate their growth rate from 8-10% in 2021 to over 20% in 2022.

Throughout the year, we have observed a steady demand but insufficient supply. Thus, a significant portion of demand still remains unsatisfied. However, high prices and increased uncertainty are already causing some buyers to withdraw from the market and wait. The results of this are fewer inquiries and a recorded decline in sales volume - indications that the market has begun to cool down.

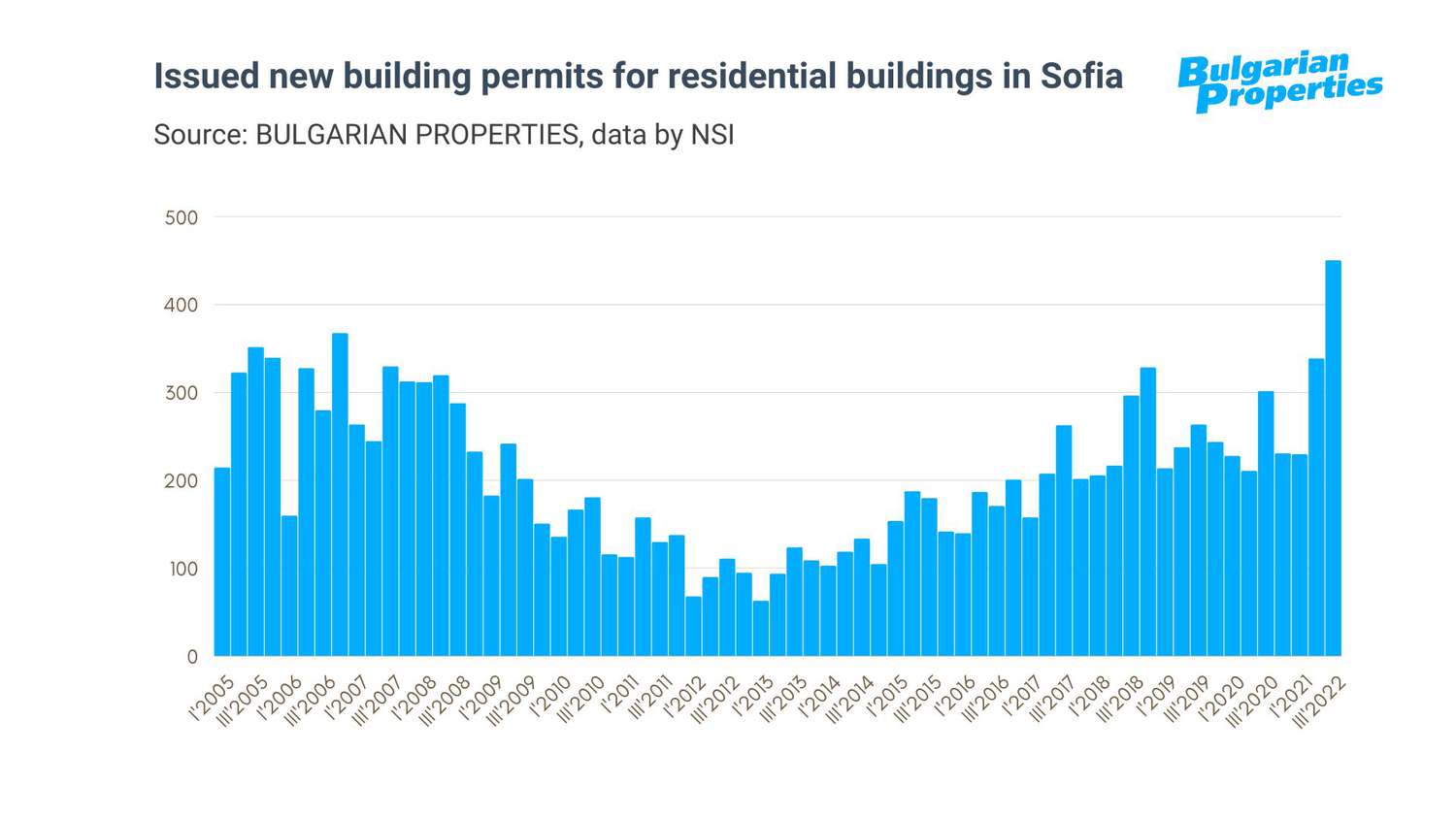

On this background, new residential building permits have registered a record growth. In the third quarter alone, 450 permits for the construction of new buildings were issued in Sofia, which is significantly above the average levels for the city and a record since these statistics have been kept since 2005. As building permits are one of the early indicators of upcoming changes in housing market cycle, we can be optimistic about it next year - the direction is still upward.

Bank financing remains available and with conditions still unchanged, at historically low interest rates.

Other factors affecting the housing market continue to be positive. Unemployment remains at low levels - around and below 5%, and incomes continue to grow, albeit more slowly than property prices - by around 16% in Sofia in the third quarter on an annual basis according to National Statistics Institute data. This keeps housing affordability at good levels and the market close to its fundamentals.

Average prices and price growth in Sofia

The average price of housing in Sofia in the third quarter, based on actual transactions, according to data from BULGARIAN PROPERTIES, is EUR 1,470/sq.m. compared to 1,425 Euros/sq.m. in the second quarter and 1,200 Euros/sq.m. a year earlier.

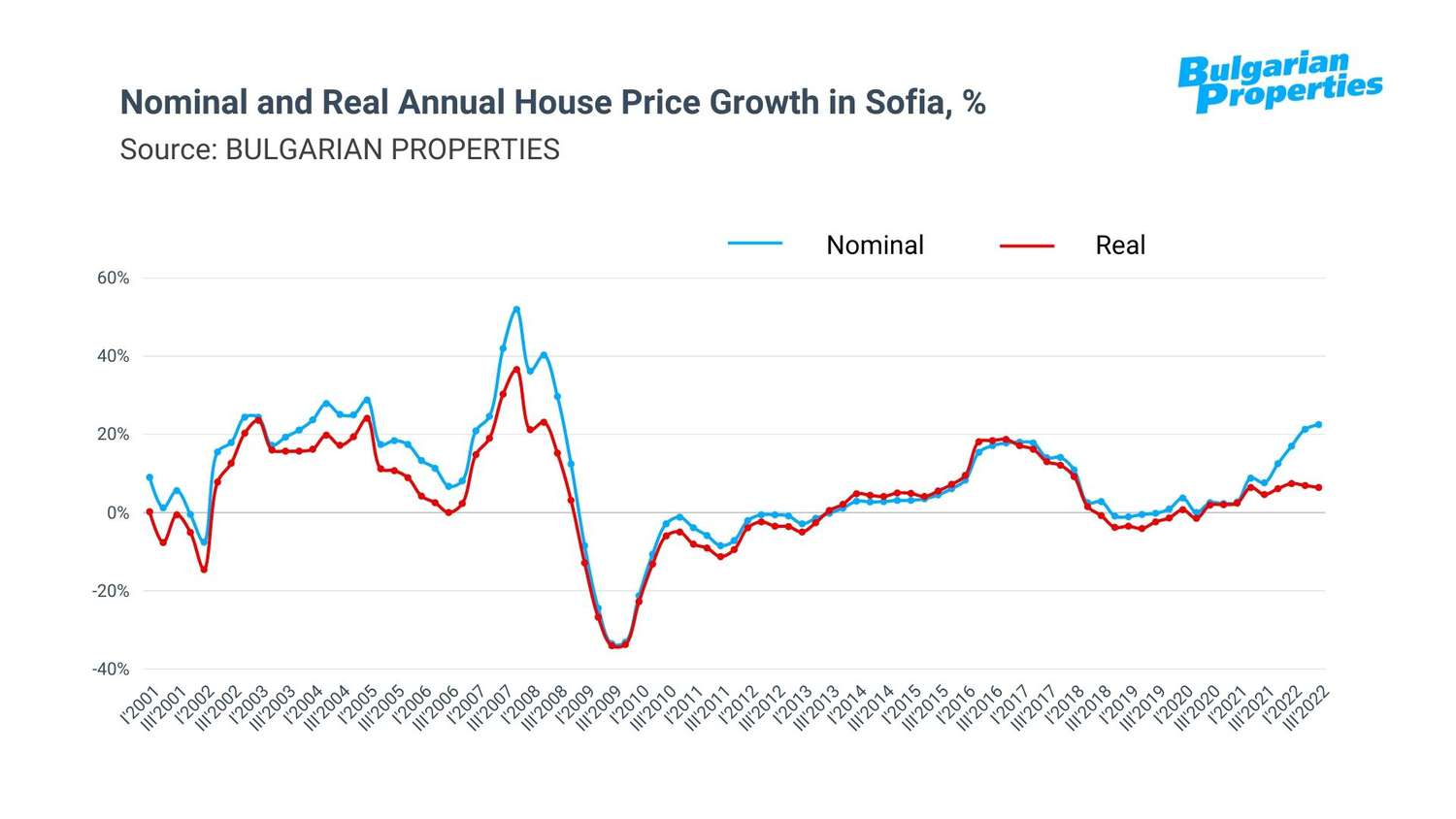

This represents a record nominal price growth in Sofia of 23% year-on-year – well above the expected levels for this year and a value not seen since 2008. In one year, the square meter in the Bulgarian capital has become more expensive by 270 Euros, but we can already see that this growth rate is slowing down. Q3 quarterly price growth was around 3%, slowing from over 11% at the start of the year and 5% in the second quarter.

At the end of 2021 prices began to accelerate their growth and from nominal growth around 8-10%, in 2022 they grew at an accelerating double-digit rate above 15%, and subsequently even above 20%.

Due to high inflation, to get an idea of the real house price growth, we need to deduct it (using the Harmonized Index of Consumer Prices). The resulting real growth of housing prices in Sofia is 6.36% on an annual basis. This shows that the large increase in 2022 is mainly due to the high rate of increase in the general price level, while the actual growth is much closer to the expected market development.

At the end of 2021 the prices from the peak in 2008 were reached, and at the moment the apartments in Sofia are being sold for around 200 Euros/sq.m. above these levels.

The average total price of purchased apartments in the 3rd quarter was 115,900 Euros. We see the overall purchase budget levels has not increased a lot, indicating that a peak has been reached beyond which buyers are less willing to buy.

Sales volume

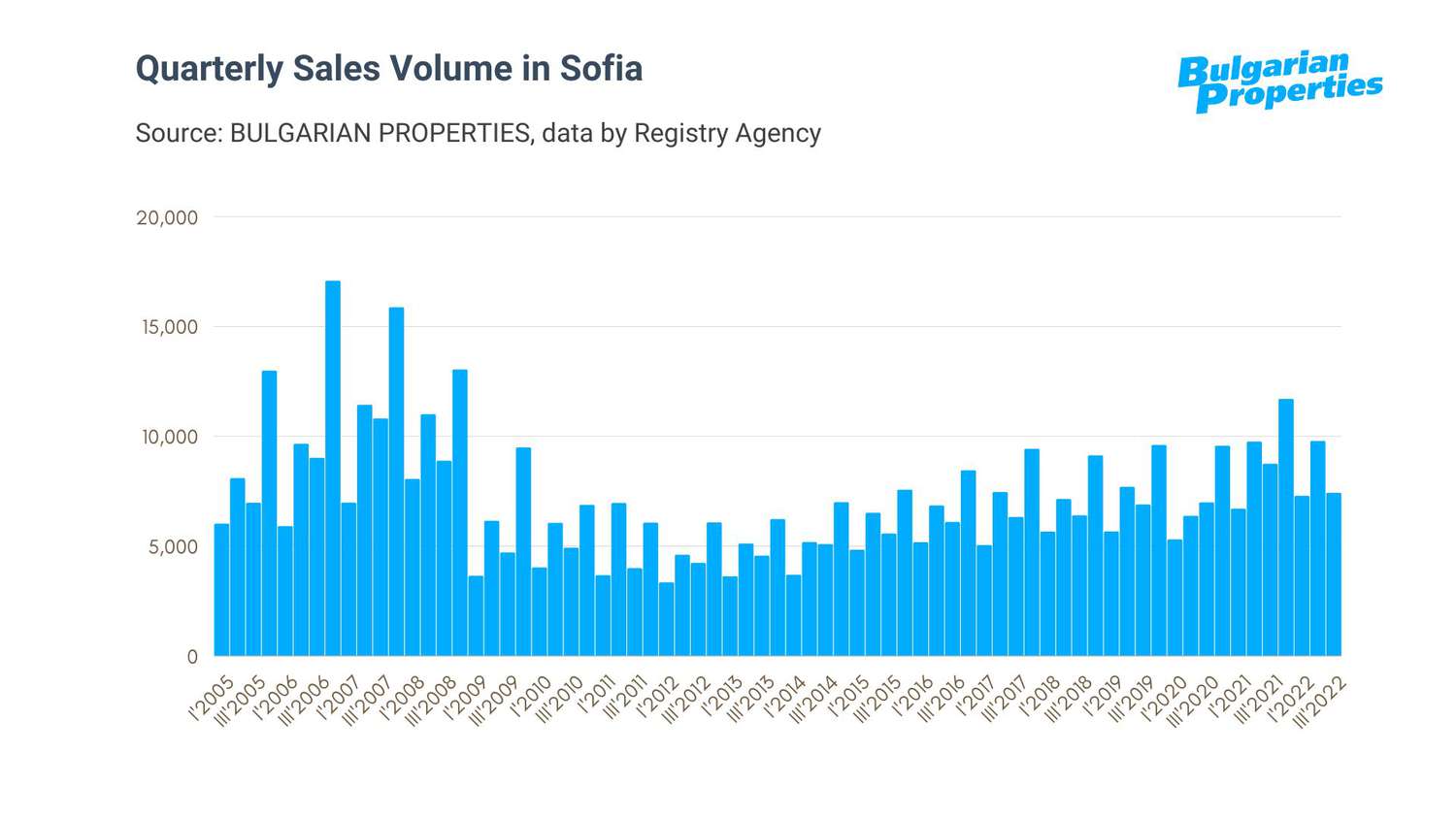

The calculations of BULGARIAN PROPERTIES based on the data of the Registry Agency show that property transactions in Bulgaria marked a decline in the 3rd quarter of 2022. This is the first decline since the market was halted at the start of the pandemic in the Spring of 2020.

The registered decrease compared to the 3rd quarter of 2021 is 7.23% in total for the country and 15.23% in Sofia.

These figures come after the market slowdown we noted towards the middle of the first half of the year and interest cooling due to high prices and insufficient supply. However, it is good to keep in mind that the reduction recorded is compared to record sales volumes achieved in 2021, when transactions growth was between 20 and 30%.

We could conclude that the initiated slowdown and cooling of the market represents a return to the normal pace of market development, which was interrupted by the pandemic and subsequently greatly accelerated in 2021.

Housing loans

Trends in housing lending most directly explain real growth in property prices, and therefore we monitor them as a major factor for the market development.

Interest rates on mortgages denominated in BGN, which are 97% of granted housing loans in Bulgaria, continued to fall in the third quarter of 2022. As of September, they are at their lowest average level - 2.46% according to Bulgarian National Bank's data.

This, together with the larger amount of granted loans due to increased property prices, determines the continued impressive rate of growth of the volume of housing loans - by 28% for the nine months compared to a year earlier.

However, here too there is some slowdown in the growth rate - from the 40% increase in 2021.

Expectations are for a smooth increase in interest rates, which will not significantly change the monthly installments of borrowers. An important role in this process will be played by the available deposit base in the Bulgarian banks and the still 0 interest rates on deposits, which keep the indices included in the calculations of interest rates on mortgages at low levels.

Affordability of housing in Sofia

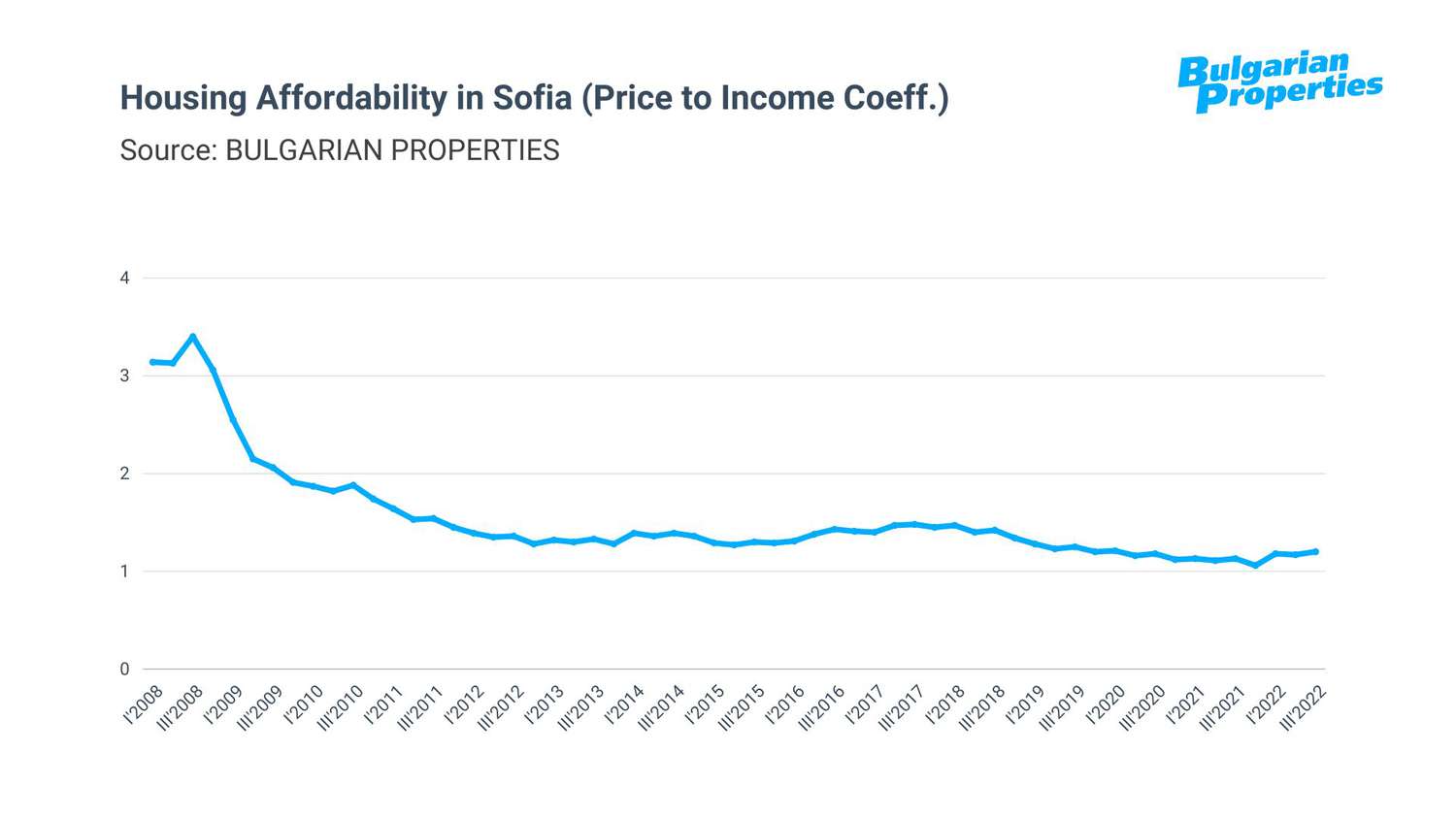

Incomes are another leading factor for the housing market, and we measure their influence through the affordability ratio, which is price-to-income ratio based on the price per sq.m. living area and the average monthly salary in the Bulgarian capital.

The affordability ratio value measured by BULGARIAN PROPERTIES in the third quarter of 2022 is 1.2.

It increased and returned to the levels from the beginning of 2020, showing a small decline in housing affordability. Currently, the purchase of 1 sq.m. apartment in Sofia requires about 1.2 average monthly Sofia salaries. For comparison, in the previous peak of the market in 2008, 3.4 monthly salaries were needed to buy the same area.

The average salary in Sofia, according to NSI data, amounted to BGN 2,390 in the 3rd quarter, which is a 16% year-on-year increase - slower than that of the housing prices. From the data on the average salary, it can be seen that the pace of its growth has slowed down in recent months, and this is another factor that will influence the housing market in the direction of cooling down.

Preferred neighborhoods and property prices in them

In 2022, among the areas with the fastest development and the most concluded deals were neighborhoods in the wide center of Sofia, such as Banishora and Zone B-5, Zone B-18, where the construction of a number of new residential development projects is underway. They completely change their look and make them a very good solution for people looking for a new home in a communicative central location in the capital.

The other hot spot in 2022 was Malinova Dolina district, where many new buildings are currently being built, mostly small apartment buildings. The environment, the new infrastructure and the proximity to Studentski Grad and many amenities, combined with the still low prices for a Southern district of Sofia, made Malinova Dolina a hit this year.

The average prices in the most popular neighborhoods in the 3rd quarter of 2022, based on actual transactions, are:

• Banishora - 1,410 euros/sq.m.

• Zone B-18 - 1,600 euros/sq.m.

• Malinova Dolina - 1,290 euros/sq.m.

• Krastova Vada - 1,600 euro/sq.m.

• Manastirski Livadi - 1,600 euros/sq.m.

Parameters of purchased homes and average stay on the market

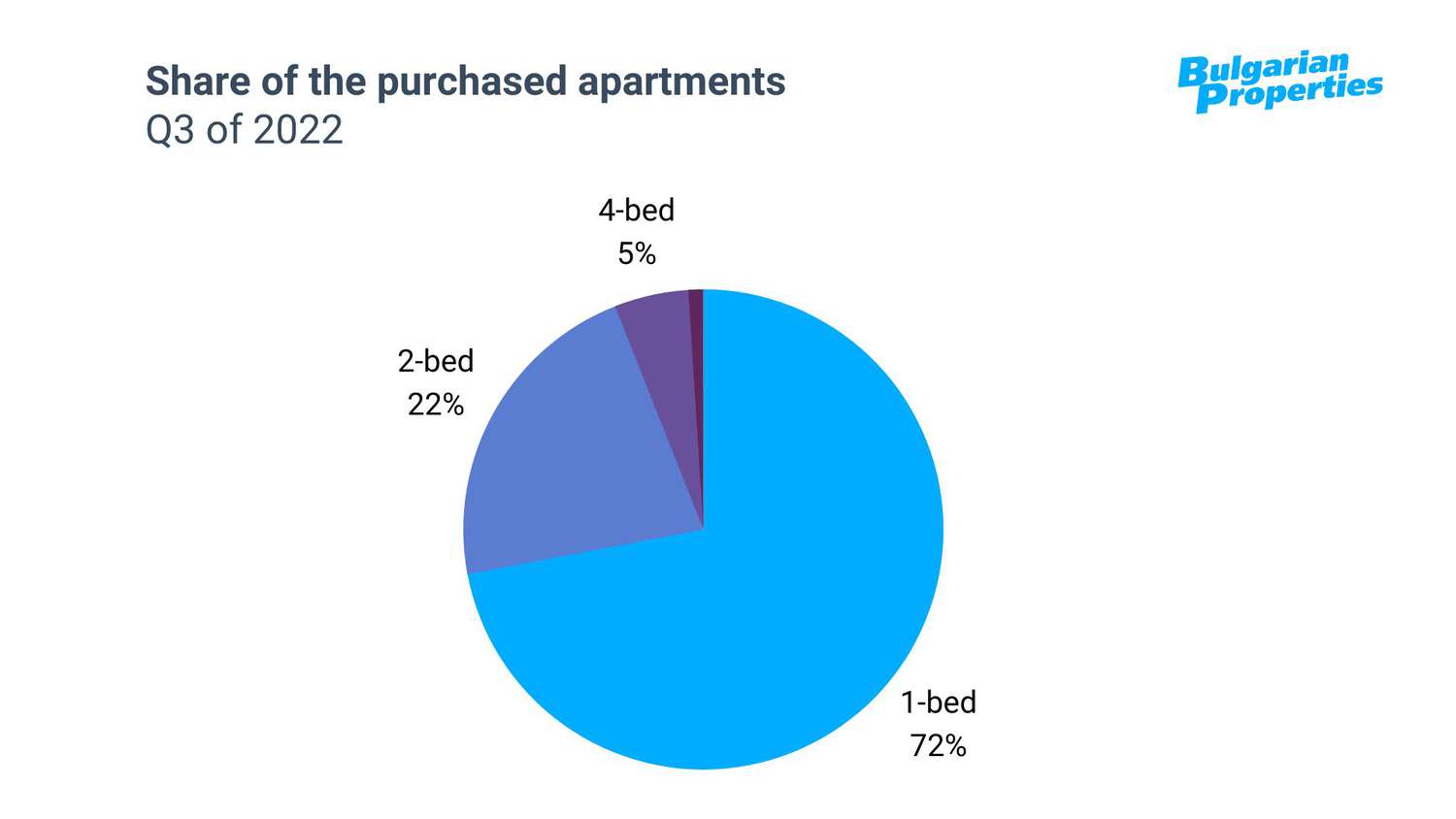

The share of the purchased 1-bedroom apartments continued to grow in the 3rd quarter and reached a share of 72% compared to 50% in previous periods. 2-bedroom homes made up just 22%, and 3-bedroom homes returned to levels around 5%.

This data stands in stark contrast to trends in 2020 and 2021, when the pandemic made people to focus their interest on larger homes, with more rooms for living and working at home.

In 2022, buy-to-let and investment to protect against inflation prevailed, and this is what has brought back interest in 1-bedroom flats. Rising prices have also likely caused some buyers to rethink their search and prefer smaller homes with a lower total price.

The average area of the purchased homes is 78 sq.m. – drop from an average of 90 sq.m. in previous periods, which once again shows the trend described above to buy smaller homes.

The most purchased apartments are on the 4th and 5th floor, and over 60% of them are heated by central heating.

The time on the market continues to be extremely short - an average of 30 days, with sales often occurring within up to 1 week. In this sense, we still definitely have a seller's market, which accordingly does not give grounds for achieving discounts from the asking prices.

View our offers in Sofia

Sell a property with us

Get a free online valuation